Didn’t find what you were looking for?

Select your institution type:

Date: 03/08/2023

For each company, there is an ideal operational format: Parfin offers three deployment models to assist institutions in the custody of digital assets.

The universe of cryptocurrencies and tokenization is advancing in Brazil and worldwide, presenting an opportunity for institutions. Prepared to meet the sector's demands, Parfin has evolved its MPC Custody, which now features seven layers of security and three operational models.

"Parfin's MPC Custody can be flexibly implemented, taking into account the security, compliance, and infrastructure requirements of each client," explains Rahul Bobba, Head of Product at Parfin.

Bobba also emphasizes the importance of regulation when choosing the custody model. "A common point among all models is that clients retain control over robust governance and compliance rules, individually configured," he says.

Below, learn about each custody model and discover which is ideal for your institution.

SaaS Model

In the SaaS (Software as a Service) model, Parfin holds all access keys and controls their sharing.

"The SaaS model is suitable for companies, such as medium-sized funds, that want to enter the market quickly," says Bobba. "In this case, the client must feel comfortable entrusting full control to Parfin, which will sign transactions on their behalf."

Hybrid Model

As the name suggests, this model divides key custody between Parfin and the contracting company.

"This model is ideal for clients who have sufficient sophistication to take control of key materials and distribute the key signing process between their company and Parfin," says Bobba.

Modelo Edição de Nuvem Privada (PCE)

This model is suitable for companies that want to become custodians: with the Private Cloud Edition, they have total control over custody keys.

"PCE is the ideal model for companies that already have high expertise in protecting encrypted keys," highlights Bobba. "This is typically the case for large financial institutions and banks."

A significant innovation from Parfin, the PCE model is not commonly offered in the market. It will play a crucial role in the near future: with the arrival of the Digital Real, scheduled for 2024, banks will need to become custodians to store tokenized assets.

Find out more: Tokenization set to pick up in Brazil with the introduction of Digital Real (parfin.io)

Custody MPC, the evolution of Parfin's custody:

As the digital economy advances, so do Parfin's solutions: Custody MPC is the new version of the product that complies with the most stringent security and governance standards.

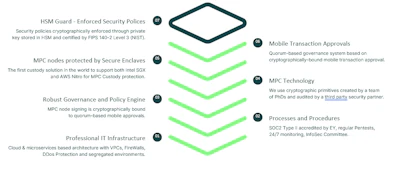

With seven layers of protection, Custody MPC offers a robust infrastructure for companies to store digital assets.

"The new version of Custody presents differentials that offer even more protection and security to companies," highlights Bobba.

"An example is the mobile approval system. With it, you can receive cryptographically validated transactions on your mobile phone and request user approvals, always following the defined governance rules."

The seven layers of security in Custody MPC complement each other to ensure highly protected processes.

"For instance, one of the MPC nodes is installed on the client's site and is entirely independent from Parfin," explains Bobba.

"Therefore, any transaction signature requires the configured quorum of approvals via mobile."

To develop the new version of digital asset custody, Parfin combined the best of MPC technologies, private computing, and HSM to build security in multiple layers, aiming to eliminate points of failure, protect against external threats, eliminate human errors, and prevent risks of internal access.

Want to know more about the Custody MPC solution? Contact Us (parfin.io)

Request a demo

Select your institution type: